A couple of weeks ago, I wrote about how lean customer insight teams work.

Sourcing minimum viable evidence – finding just enough customer data to help feed high-tempo decision making – is one of the core principles of lean insight. The tools to help with this include …

- free and low cost ways to analyse web, search, social and e-commence data

- smartphone qual and ethnography apps for fast contextual insights

- automated survey-based tools to prioritise and validate ideas.

I thought it would help if I went a bit deeper on some specific examples.

Free and cheap source of data and analytics

Information (almost) wants to be free – as someone said. (In 1984, ironically).

In 2018, we’re seeing more and more data available at zero or very low cost, and it’s a huge boon to marketers and insight professionals.

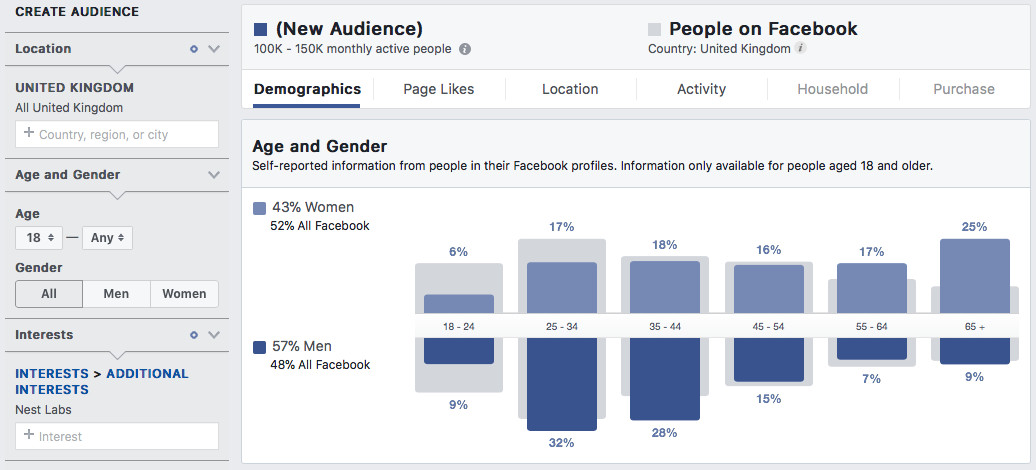

If you have a facebook account, you have access to facebook audience insights. Built as a media planning tool, it also is a fantastic resource for quickly generating segment hypotheses or profiling brand users (or brand likers at least). Give it a go, and try not to lose an afternoon as you discover that people who like Nest home automation (including lots of women over 65) are 288 times more into Kettle Chips than the average Facebook user.

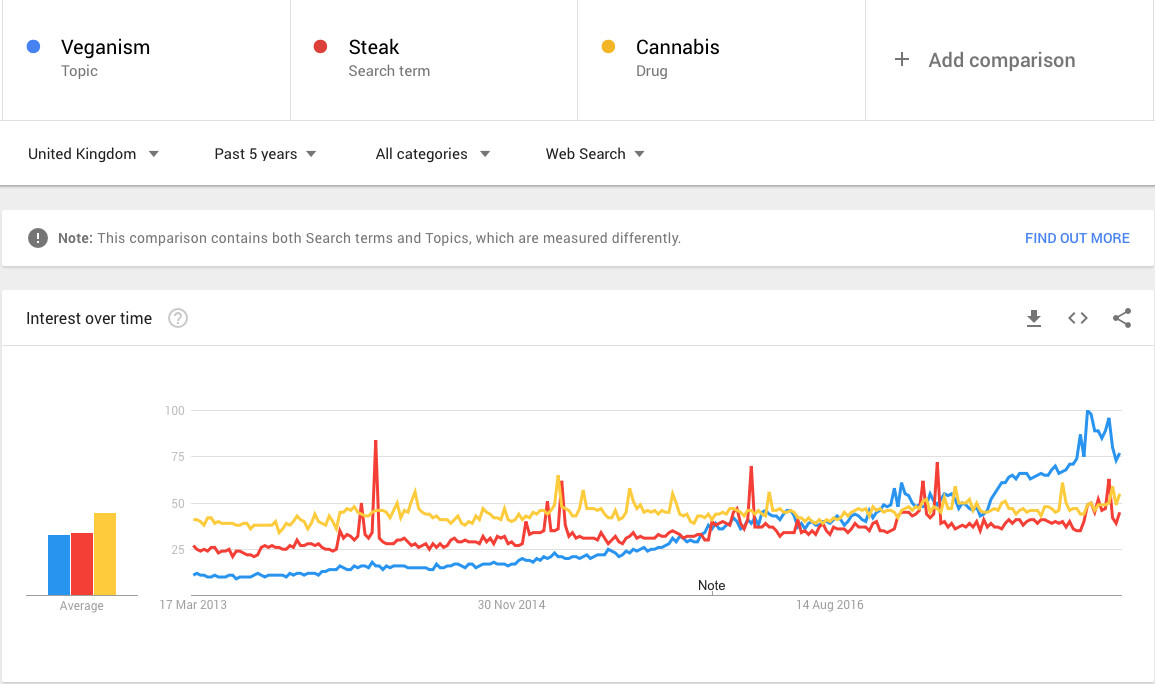

Google Trends data can be interrogated for the same price. If you’ve read Everybody Lies (and I recommend that you do), you’ll appreciate just how much the Google search box acts as a digital truth serum. It’s where people confess their darkest desires and nastiest prejudices. But more safely, it can be used as a pretty good proxy for brand tracking and monitoring shifts in category interest over time. Who knew that searches for veganism in the UK have now overtaken not just steak – but also cannabis?

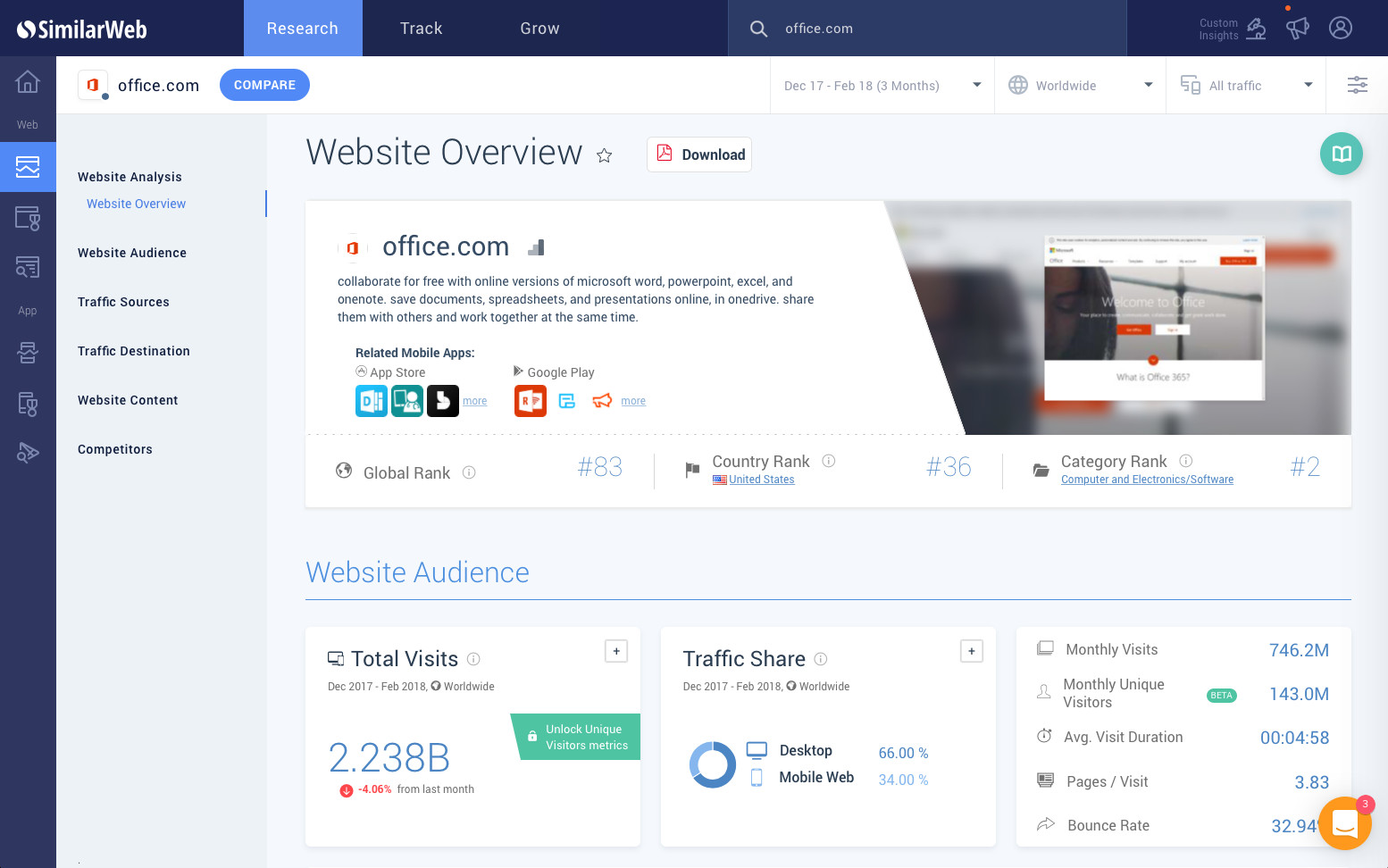

For website and competitor insights, you can take out a trial of Similarweb. The free version is actually pretty good. Pick any website and see a breakdown of its audience, traffic sources and competitors; you can also see app store analytics for many properties.

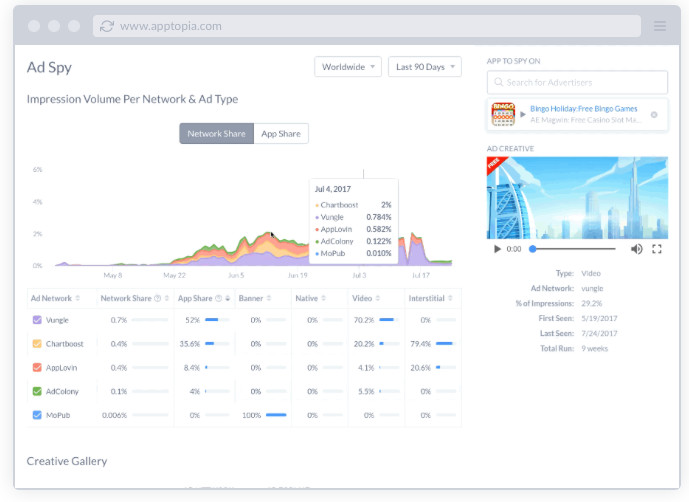

If you have your own smartphone app developer account, you can get free data on 10 competitor apps from apptopia.

If you want free social analytics to get a quick view on trends for a brand, product or category, you can build some baseline knowledge using socialmention (or dozens of other free social analytics tools).

If you want to know what people are saying about your product or your competitors on Amazon, you can scrape reviews using free tools like Data Scraper or a free trial of Dexi.io (there are also many different ways to do this if you know how to code). We did it here, and used both Heartbeat and Chattermill to work out what it all meant.

You can also use free versions of some text analytics tools. Meaningcloud’s free plan, for instance, will analyse up to 20,000 text items a month using an Excel plug-in.

If you want to know what’s selling on eBay, you can subscribe to Terapeak. Yes, you pay for this one. But it’s $12 a month. Come on.

And not to neglect the B2B people – check out Owler, a new platform for competitor intelligence. And yes, this one is free.

All this really is just scraping the surface: there are hundreds of low cost solutions for gathering consumer and B2B data. Always worth checking what can be had for free before paying to gather fresh data.

Smartphone qual and ethnography apps

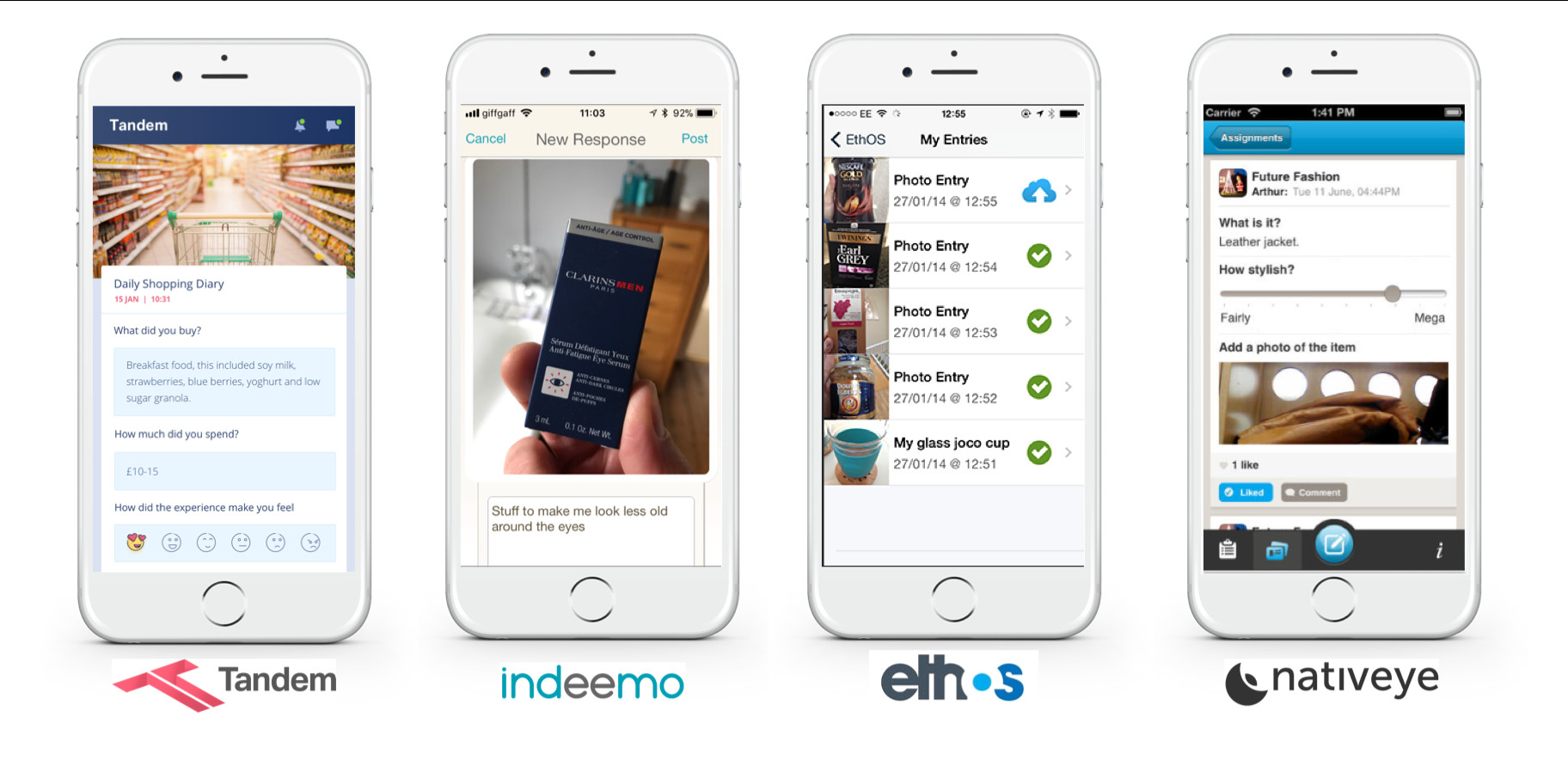

Many different solutions are now available for smartphone-based mobile ethnography and qualitative research. These apps are generally task-based (record a selfie video about your haircare routine) or mission-based (go to a store and take photos of the wine fixture).

Most allow participants to upload pictures, video and text; some have polling / survey features; and some allow moderators to chat with participants in real time.

In the last few months, I’ve seen these tools used for …

- in-store video of shoppers at the ice cream cabinet

- overnight insights into cosmetic products used by men

- pre-task missions to low cost gyms before in-person focus groups.

These tools are great at generating minimum viable insight for product decisions, building contextual understanding of user behaviour and even seeing how things are done in unfamiliar markets. Just how do people make prepare breakfast Vietnam?

Providers include Tandem, the new research platform from Further (previously Dub); Indeemo, which we used for this innovation workshop; and several others including nativeye, ethosapp, crowdlab and Over the Shoulder.

Automated survey tools

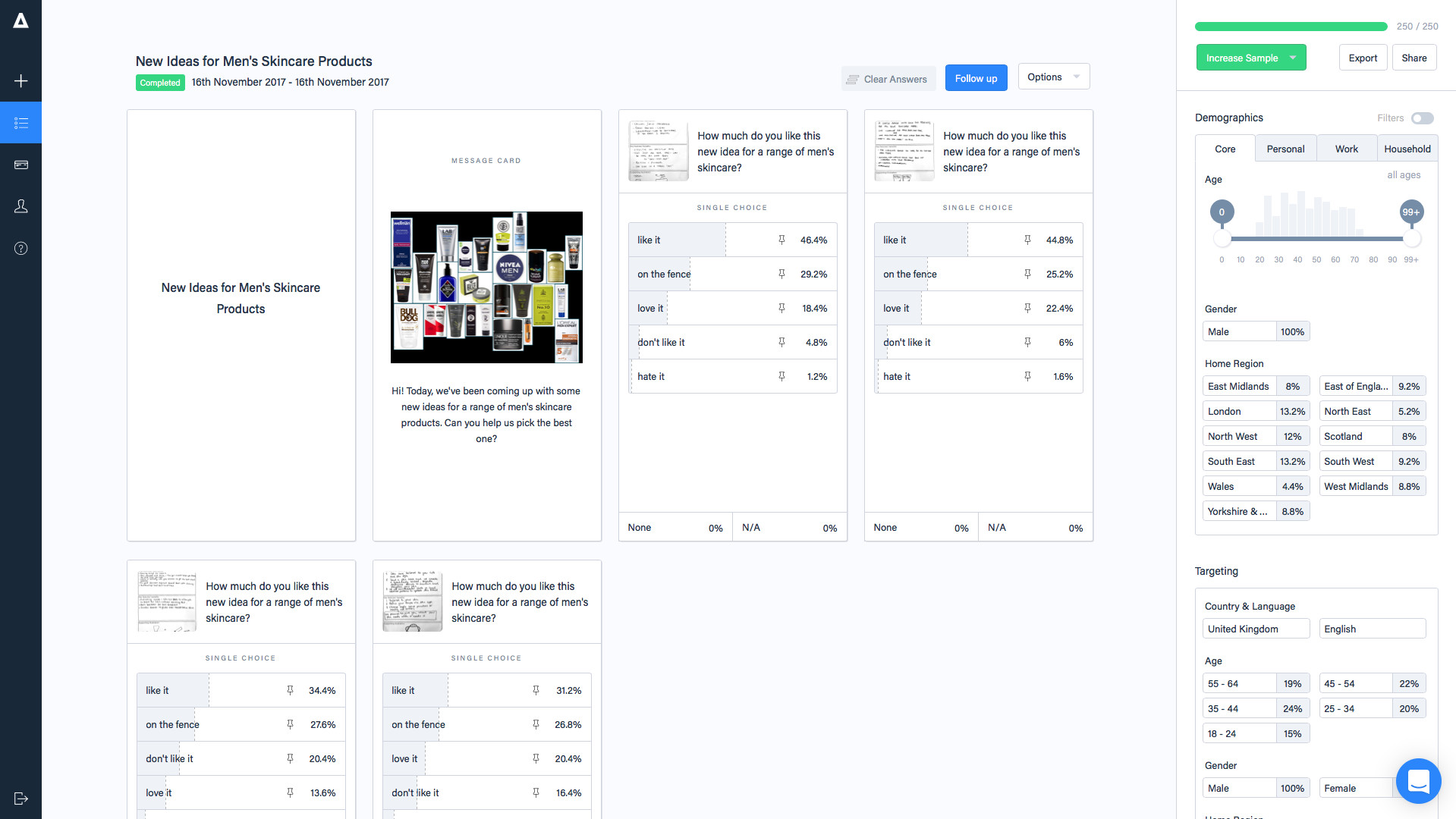

Attest is an integrated platform for rapid market feedback and brand tracking. Users build short surveys, select the target audience, launch the project and analyse results all within the platform. The company claims average turnaround times of 24 hours for 1000 responses (we got 250 within an hour here). Brands including Treatwell, Deliveroo and Carwow are customers.

Attest customer DogBuddy is the leading European app for connecting dog owners with providers of boarding, walking and dog sitting services. The business gathers feedback continuously from users (via TypeForm) and potential users (through Attest) to inform strategy, product and marketing decisions.

“Tech companies can over-rely on feedback from existing users,” says DogBuddy CMO Simon Goble.

“We’re growing our base, so we need the views of potential users as well. We run a regular brand intelligence tracker on the platform, and that helped us pick up some competitor issues and led us to speed up our plans for key UK cities other than London.”

“We also use Attest to answer urgent customer questions”, he says. “For example, DogBuddy is used mainly to find boarding services – but walking is a big growth opportunity. We were running a campaign to support this, and needed to confirm some assumptions we were making. A quick survey of 250 people gave us the hierarchy of reasons people have for hiring a dog walker – and we used those insights to finalise our copy.”

“I’ve used research agencies in previous roles. I liked their advice and knowledge, but those timescales and costs just don’t work in this sort of business.”

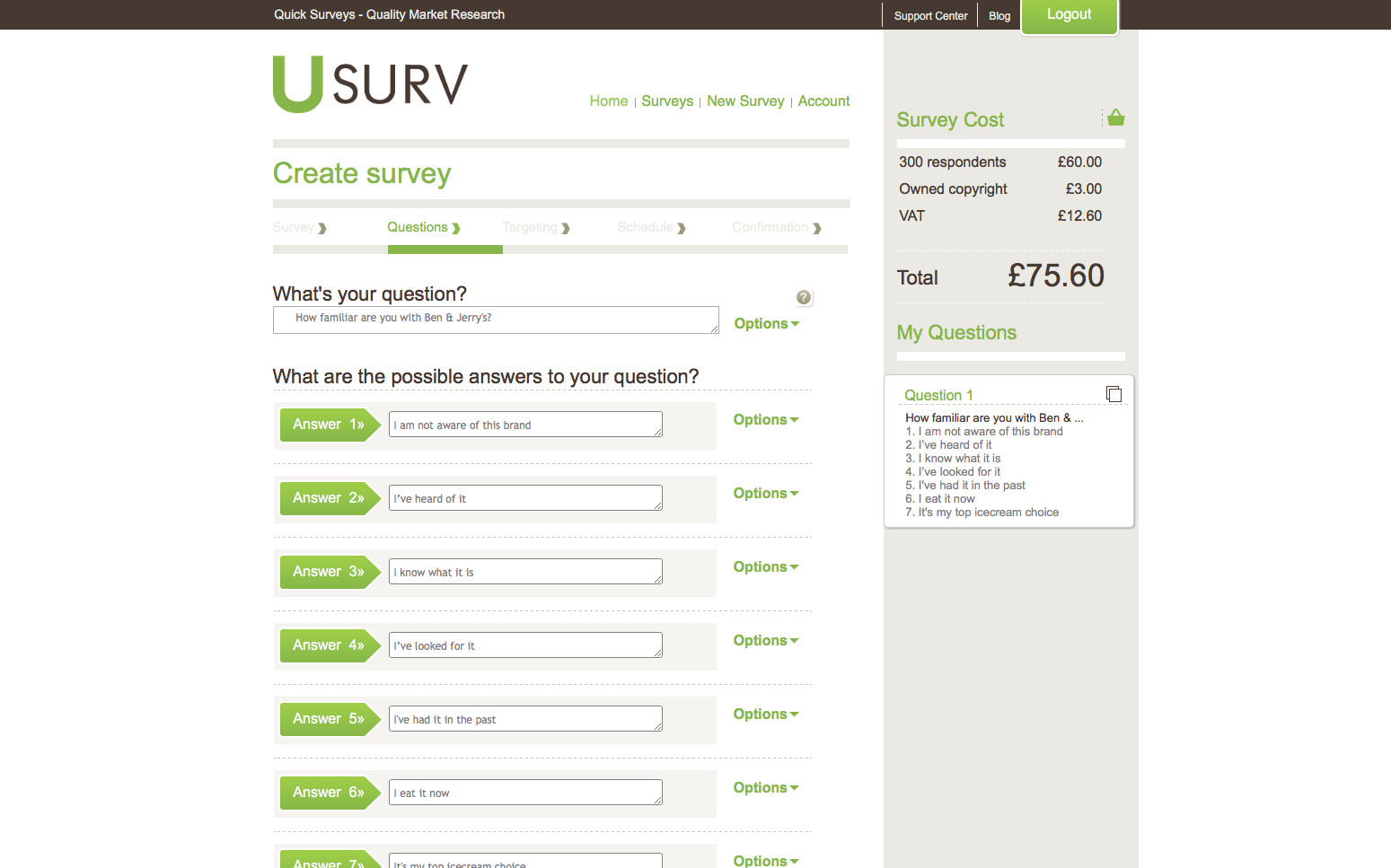

maru/usurv offers another platform for rapid testing, with micro-surveys distributed across publisher networks.

BI Ventures, part of The Behavioural Insights Team, worked with the maru/usurv platform to build a “fast, agile and behavioural testing solution” primarily for government research.

“We wanted to develop a platform where we are able to run short online randomised controlled trials (RCTs), enabling governments and others to make quick, evidence-based decisions”, says Charlotte Bearn, Head of BI Ventures. The result is Predictiv, which generates short, online behavioural experiments.

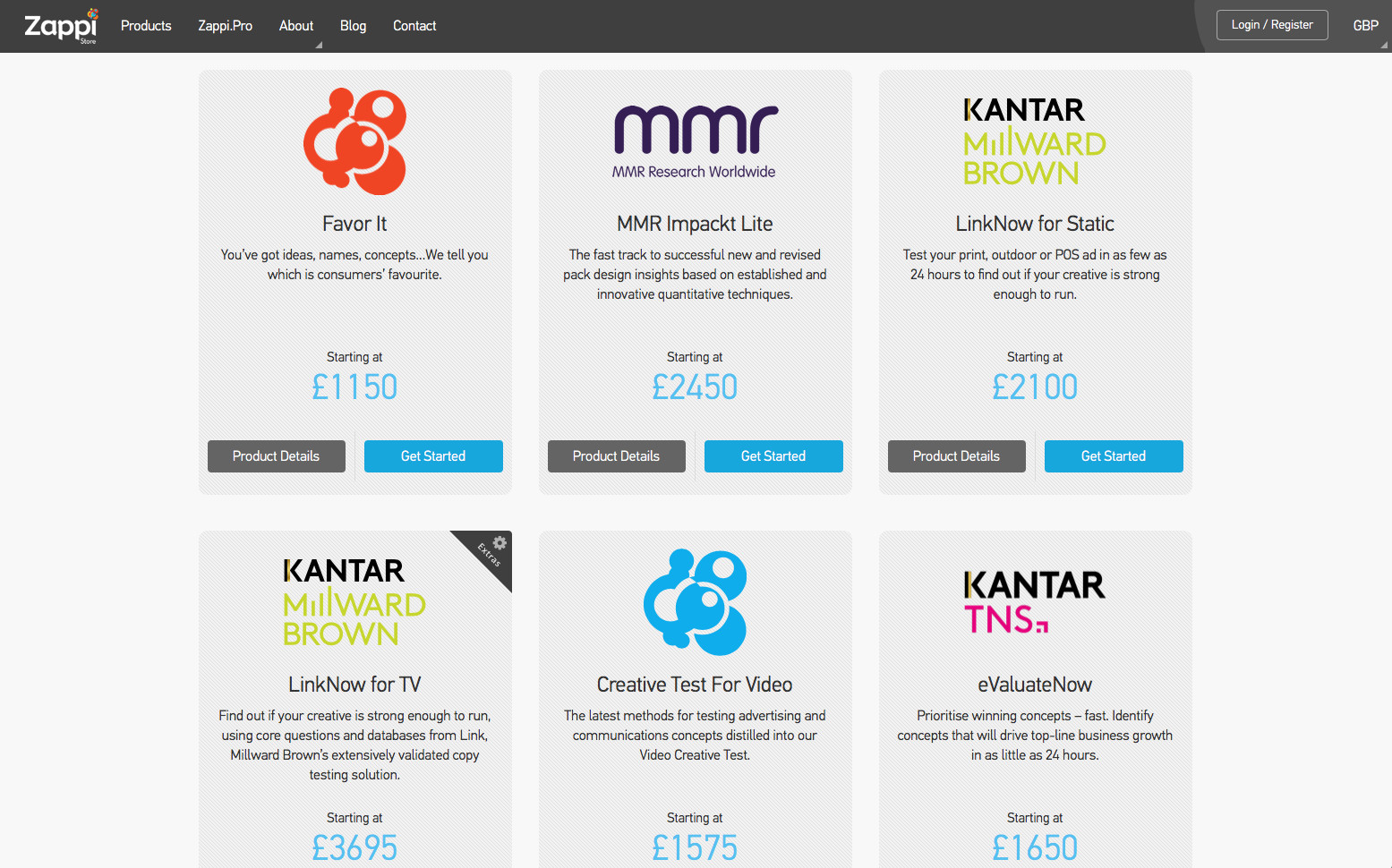

Zappistore has a range of 20 automated survey products for testing ideas, concepts, packaging, claims and ad copy – using its own research designs and those of partners including Kantar Millward Brown, System1 (Brainjuicer) and MMR.

PepsiCo uses the Zappistore platform to quickly pre-test creative copy, seeing benefits that include “[bringing] insights and creative teams together … improved communications and shortened action times”.

Other providers in the automated research space include survey panels Toluna (Quick Surveys) and ResearchNow SSI (Samplify); and new entrants Gauge and Twentify.