What is Brand Tracking?

By Insight Platforms

- explainer

- Brand Tracking

- Brand Research

Brand tracking is the process of listening to consumers’ perceptions about brands and markets through time, to make informed strategic decisions and follow up on the outcomes. Its main outputs come from survey results, and could be combined with additional information.

Why Are Brands important?

According to Harvard Business School professor, Gerald Zaltman, brands represent 40% of the largest global companies’ value. And 95% of purchasing decisions are based less on thinking, and more on feeling.

Simon Sinek said in the book Start with Why that “people don’t buy WHAT you do; they buy WHY you do it”.

And that’s where the brands come in. Brands tell consumers what the company thinks, does and stands for. They have the power to engage, drive loyalty and grow businesses.

For example, consumers don’t go to Starbucks for just coffee. They go there for the experience – and are willing to pay 5 times more for a cup of (Starbucks branded) coffee.

Stay up to date

Subscribe to receive the Research Tools Radar and essential email updates from Insight Platforms.

Your email subscriptions are subject to the Insight Platforms Site Terms and Privacy Policy.

Amazon is always in the news, either because of Jeff Bezos trip to space, or for dominating e-commerce.

Newsworthy commitments – like paying customers for property or personal damage caused by products bought on Amazon – are public demonstrations of care for consumers’ wellbeing. Such ‘brand-focused’ actions lead directly to commercial value: according to Kantar’s BrandZ™ Most Valuable Global Brands study, the value of Amazon’s brand increased by 64% in 2020 to be worth US$684bn.

Long story short: brand is money!

Have I got your attention now?? Then let’s see what Brand Tracking is all about…

What is Brand Tracking?

Brand tracking is the ongoing research into the performance of a company’s branding efforts. It measures consumers’ awareness and associations with a brand; and frequently tries to model the relationship between these perceptions and ‘hard’ measure of sales, usage and market performance.

Brand tracking allows marketeers to make informed strategic decisions as they try to increase sales, deliver better ROI, change brand positioning or win market share and value.

What is Brand Tracking Good For?

Brand tracking should not be about vanity metrics; it should provide good evidence for data-driven driven action.

Tracking a brand’s performance over time allows you to:

- See how it is performing against competitors.

- Understand the efficiency of marketing campaigns.

- Evaluate and optimise media mix effectiveness.

- Evaluate creative content performance.

- Understand your brand’s target profile, customer loyalty and perceptions.

- Know more about the preferences and challenges of your brands’ consumer base.

And many others…

It shows, for the more attentive eyes, future opportunities like:

- Positioning white spaces, for brand differentiation or new brand development.

- Targeting specific customer groups.

- Identifying communications sweet spots.

- Managing a brand and products portfolio.

And again, many others…

What Does Brand Tracking Measure?

A brand tracker is the tool that measures the success of your brand building initiatives.

In most cases, a brand tracker is a regular survey (usually monthly, quarterly or annual) with consistent questions and respondent samples so you can make valid comparisons over time. Surveys can be enhanced with other data sources to improve accuracy or depth of understanding (see below); but the main focus of this section is on brand tracking surveys.

Surveys track the main KPIs (Key Performance Indicators), defined by strategic intent, evaluating long term performance and how actions affect consumers’ behaviour.

A good way to guide the evolving performance of a brand is using the Brand Funnel – a typical brand tracker result. It shows the main steps on the journey from indifference to loyalty for a brand.

Let’s take a look over the most common Brand Tracking metrics to watch:

Brand Awareness

It shows the strength of a brand’s mental availability, determining the brand association with its category. It can be spontaneous (“which brands of catfood can you name”) or prompted with logos, lists, etc (“which of these catfood brands are you familiar with?”).

Brand Consideration

Among all brands available and known, this metric shows the ones consumers would consider buying. It defines the competitive set in the buyer’s mind.

Brand Preference

This is one of the most important brand metrics. It shows which brand consumers would choose over all the others.

But it can be misleading! Sometimes choice is not really up to consumers. Price and availability, for example, are also important drivers. Just to illustrate, my favourite car may be a Ferrari – but that doesn’t mean much if I can’t afford one.

That’s why we also use:

Brand Purchase

This adds a more realistic perspective than looking into preference alone. The most often purchased brand is more relatable to market share. And it helps identify substitute brands to the preferred ones.

Brand Loyalty

It measures action and intention of buying a specific brand again. It comes from past purchases or future purchase intention.

Brand Rejection

Not all brand experiences are great and lead to a healthy relationship. A bad personal experience, or even a public incident, could damage a brand’s image. It is key to understand if anything unusual is driving consumers away.

Brand Perception

This helps with understanding what drives category purchase, and the performance of brands against those drivers.

The brand footprint is measured using questions about brand attributes. Consumers rate brands against specific emotions (“makes me feel confident”, “is a generous company”), experiences, and perceptions. Brand perception is for diagnosis, and understanding brand’s benefits, strengths, and weaknesses.

Advertising & Channel Recall

We need to be very careful about relying on consumers’ memories of brand advertising and media channels; it’s very hard for people to remember the when, where and what of communications campaigns.

But adding such questions to brand tracking surveys can help determine if brand communications are cutting through the market fog. It helps to understand whether and how much campaigns affect brand health, and if any specific media channel drives greater salience.

How Does Brand Tracking Impact Brand Strategy?

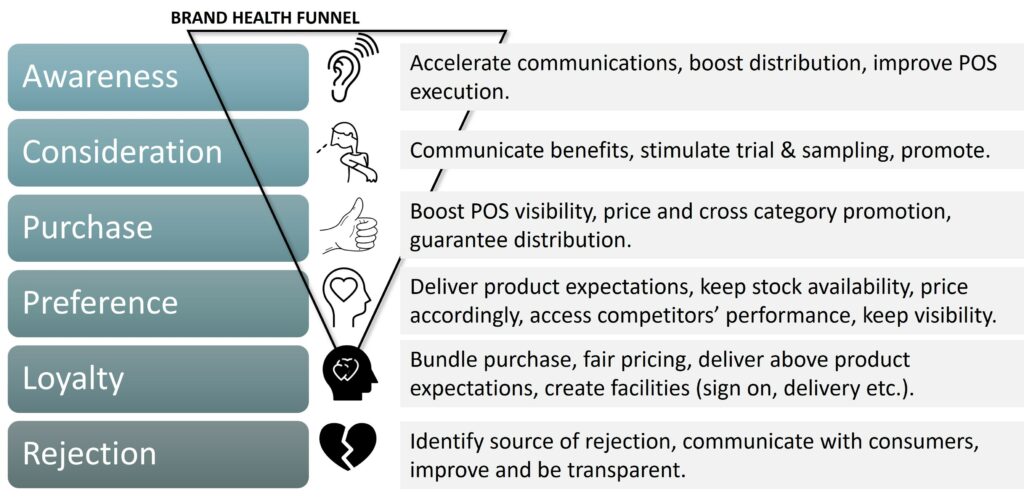

The survey measures from each step of the brand funnel have specific diagnostic implications – especially when performance is below expectations.

Here are some example actions that are implied by under-performance at each funnel stage:

Is Brand Tracking Only Survey-Based?

Surveys are by far the most established method for measuring consumer perceptions of brand performance. In many companies, the survey results also drive some of the bonus calculations for marketing teams and senior leaders – so, understandably, people are reluctant to make major big to the designs of long-running brand tracking studies.

But increasingly, comprehensive brand tracking frameworks enhance their surveys with data from additional sources. Some examples include:

- Social Media: volume of mentions, sentiment analysis, engagement rate, reach and many more.

- Online search data to understand shifts in consumers search patterns.

- Share of voice and share of spend to access if investments are compatible to the market.

- Sales Data: market share, distribution, price, penetration, frequency.

- CRM data analysis: frequency of purchase, number of items, recurrence.

- Competitor actions: changes in positioning, price, pack, new ads, new media strategy.

- Internal Sales data: sell in, sell out, main clients, lost clients.

- Qualitative research to deep dive and enlighten diagnosis.

What are the Main Brand Tracking Pitfalls to Avoid?

Ignoring time sensitivity

Don’t jump to conclusions after the very first wave; understanding your brand takes consistency, investment, and patience. It may take several waves to build up a full picture – and even longer to see the impact of any investments you make. Consumers don’t change their perception of a brand overnight.

For some marketers, it can be tempting to change communication every year in order to try and and boost brand tracking results. But this is really the tail wagging the dog – and means that most campaigns are killed before they have had time to really pay back.

Remember: It took Nike a good 10 years before they could use the swoosh without explanation.

Including only weak competitors – or none at all

Not having the fair competition, or not giving them the chance to have a better performance is as dangerous as not researching at all.

Include the best competitors and try to represent as much of the market you can. Looking through skewed results will drive your brands nowhere.

Researching the wrong audience

The better the sample represents your target population, the more you can relate results to real commercial performance.

Investigating only your core target will lead to a deludedly positive performance, and won’t show you where you need to improve.

Setting unachievable brand goals

Over-ambitious targets to improve awareness, consideration or loyalty metrics will back-fire.

Time is essential for building strong brands, so don’t expect your brand can increase purchase intent by 10% in 3 months. Manage your expectations!

Confirmation bias

Brand tracking results can often be compromised by biased hypotheses, a determination to be proved right or simply looking for some good news.

Sometimes results are not conclusive by themselves, and need to be broken down and combined with other metrics to make sense. There are always several approaches for analysis, any one of which could lead to different results.

Insufficient sample

It is all about statistics – sufficient sample enables allows you to analyse sub-groups more confidently. A sample that is too small could disguise statistical differences and hide information that could be insightful.

Rushing through the questionnaire

As in any kind of research, the questionnaire is as important as the results. Pay attention to questionnaire order. Follow the pattern: spontaneous first, branded second, reasons and attributes (more exploratory and rational) at the end.

Over-stimulating or priming respondents with category or brand information can contaminate subsequent questions. Remember that consumers don’t overthink purchases, and they don’t choose brands consciously. The less you stimulate them in the survey, the more reliable and unbiased your results.

5 Steps to a Great Brand Tracking Framework

Brand Tracking is a repeatable model, where you are constantly re-evaluating success; but success or failure is also a function of many market conditions that you don’t control.

These principles are not rocket science, and you can actually apply many of themto any research design:

- Start by determining what success looks like. Establish the brand’s market, goals, positioning, and communications message prior to anything.

- Determine the competitive framework. Against which brands will you measure your success?

- Plan analysis and statistics before kick off. The sample, methodology and data collection are affected by the need to investigate specific targets, regions, or breakdowns. They are key to determining the size, distribution, and most suitable methodological approach. Ensure you have enough data for differences in your KPIs to be statistically significant.

- Be creative analysing results. Brand Tracking is relatively stable, and it is common to get stuck into the reporting framework and just look at what’s moved up and down in the last period. Dig deeper for the stories by filtering, cross-tabulating and exploring sub-groups to find new trends, consumer behaviours and competitor changes.

- Fix and Repeat. Adjust your route and keep on tracking. Only time will tell you if actions have really moved your brand performance over the longer term – or just triggered a blip in short term sales activation.