There are many flavours of social intelligence, with many names. Different providers often use different descriptions, and some muddy the water further by having proprietary names for their own solutions.

Broadly speaking, you can split social intelligence into two groups. The first is a tactical approach, which we will call social listening. The second is a more strategic approach, which we will call audience intelligence.

Social listening

By social listening, we mean deriving insight by analysing existing social media. This can be from both your owned channels and earned mentions on public channels. This is an approach that fits well with agile insights.

“Boom. I press it and, within two seconds, we have breaking news”, said Donald Trump. And, for once, he was speaking the truth. News does break rapidly on Twitter. Think George Floyd and the Black Lives Matter movement. Kanye West running for POTUS. Or even Elon Musk and Grime’s bizarre baby name (X Æ A-12 – in case you were wondering) … All out there and retweeted or shared before the news media could pick up the stories.

Social listening is perhaps more useful in a marketing context than for insights. It’s useful for monitoring your brand and competitors, and reacting to PR opportunities or threats, in real time, as they present.

Solutions for social listening are typically platform-based, automated, cheap, and fast, and often link to content management tools.

Audience intelligence

By contrast, audience intelligence involves more complex analysis. It uses data from social media alongside other public sources such as blogs, reviews, news feeds, forums and search queries. This type of data is primarily unstructured text, in many languages, and often also contains images and emojis.

The challenge for audience intelligence companies is in finding the signal amongst the noise. They do this by cleaning, collating, coding and contextualising the data. Then they apply data science and AI techniques such as machine learning and natural language processing (NLP) to find patterns. They also use human expertise, both in creating the right data models and in conducting further analysis to derive meaningful insights.

Audience intelligence approaches can deliver insights at a descriptive level, by showing what’s happening and any changes in real time. But the more interesting applications give results at more of a diagnostic level. They explain why something is happening, which can feed into strategic decision making.

Benefits of audience intelligence

While audience intelligence approaches aren’t usually as fast as social listening, they can still be part of an agile insights strategy. One key advantage of audience intelligence over traditional methods is that there is no data collection phase. The data already exists, and analysis can start on day one of a project. This saves you the time it would take to create, field and process a traditional survey.

Another key advantage of audience intelligence data for agile insights is that there is a lot of it. Twitter alone had 166 million average daily users in Q1 2020. This means that you can target niche groups or topics. You can achieve sample sizes that would be too expensive, time consuming, or even impossible to reach, using traditional methods.

Social data also differs from traditional research data in that it is created spontaneously. This means it reflects what people want to be talking about and sharing, and how they actually speak. They aren’t constrained or led by question wording, responding to stimuli, or incentivised to take part. This isn’t to say that everything someone says on social media is true and accurate. But it is certainly unprompted and freely created, meaning you can uncover insights that you may not find using other techniques.

What social intelligence is used for

Brand tracking

One of the most widespread uses of social intelligence is to pick up brand mentions.

At the most basic level, using software that picks up keywords alone allows you to track the volume of mentions. This shows how much your brand and products are being talked about, on your own social media channels, and publicly. You can also monitor how that is changing.

However, it becomes even more useful when you add details such as who is doing the talking, and what are they saying. More complex software can identify and classify named entities into pre-determined categories, such as names of persons, companies or places. It can also conduct sentiment analysis, or what is known as ‘emotionAI’ to understand the emotions behind all the mentions.

Context is essential here. When someone says ‘Wow, [brand], great service’ is that a positive sentiment? Or are they being sarcastic and negative? How about if they’ve added some hand clap emojis? Is it applause? Or the slow hand clap of disappointment? Social intelligence companies add value by understanding that context, and coding data in a meaningful way.

Brand tracking: a case study

A great example from Brandwatch shows how social intelligence can uncover drivers behind brand mentions.

Ben and Jerry’s always increase their social media ad spend when the weather is due to be sunny. It seems obvious that people eat more ice cream when it’s hot. But during a big snow storm in New York, the company couldn’t understand why their ad click-through rates AND their sales were up.

Using social intelligence, they tracked their brand mentions during bad weather and discovered a valuable audience insight. When rain forces people to stay in watching TV, they want ice cream to go with it. This insight led to a partnership with Netflix, and a new flavour, Netflix and Chilll’d.

Competitive analysis

You can also track your competitors’ brands to understand how they are doing in the market. You can see their USPs, brand positioning, and how people talk about them in relation to your own brand.

One big advantage of the social listening approach is that you can pick up emerging competitors before they become mainstream. In traditional research, you have to define your own competitor set, so new start-ups can easily be missed. This means you’re tracking the same old names over and over, and missing some of the picture.

With social intelligence, your audience defines the competitor set for you. This enables you to respond much more quickly to innovations and changes in your market.

Crisis management

Because you can be constantly tracking your brand, you can get instant information about negative mentions that are trending.

Sometimes the crisis is something you know about, such as a product recall. In such a case you can use social intelligence to understand how the incident is being talked about. Additionally, you can ensure the tone and content of your messaging is working, and not making the situation worse.

Other times, there may be a crisis that you know nothing about. An ad may be perceived as offensive, a product misused, or an employee or ambassador behave inappropriately. In such cases, social intelligence is key. It brings the issue to your attention as it is happening, enabling you to react appropriately.

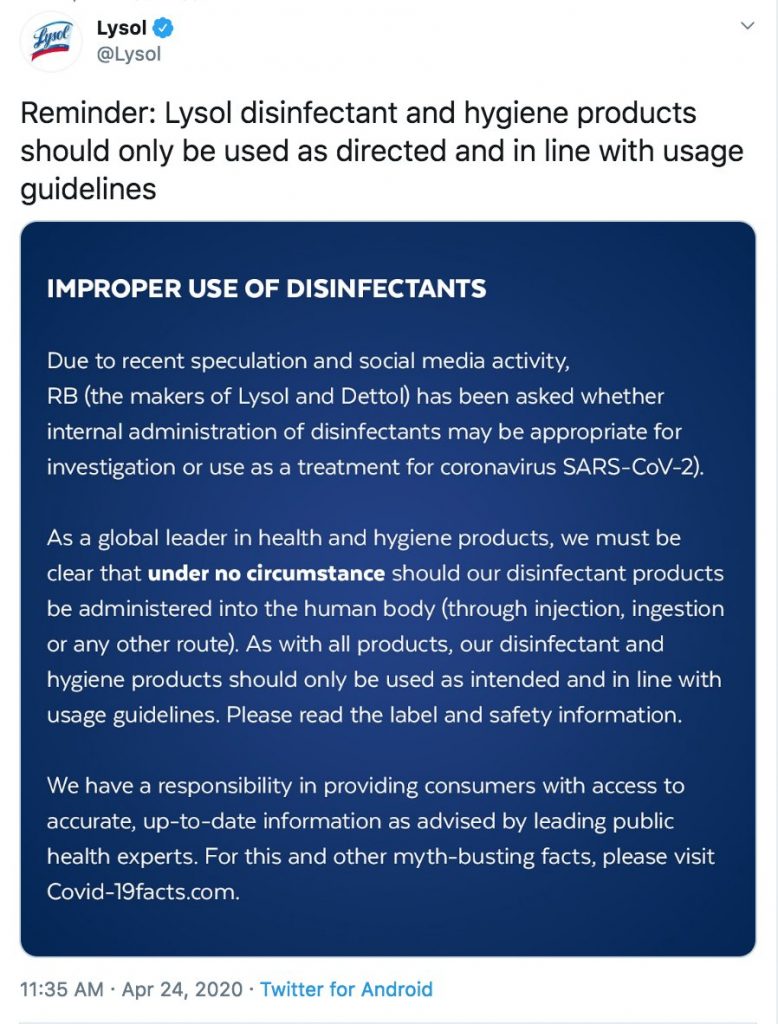

Sometimes a crisis is an opportunity. For example, when Donald Trump (yes, him again) told people to bleach their insides, Reckitt Benckiser were quick to respond. They released messaging that explained that you really shouldn’t be doing that, after their disinfectant brand, Lysol, was named in 125,000 tweets following the White House press conference.

Identifying trends

One of the main uses of social intelligence is in identifying trends.

Social intelligence platforms can spot and track new topics, behaviours, and interests. They can identify them as they emerge and gain traction, pinpoint when they become mainstream and peak, and track decline as they die away.

Trend spotting can be about managing and benefiting from short term trends. Alternatively, they’re about predicting the future, to inform innovation and product development. The recent Covid-19 crisis has seen trends spring up and die down within the course of just a few weeks. Thankfully, nobody is stockpiling loo roll any more but, for a while back in March, this was major.

What can be more useful is to understand which trends will stick. Audience intelligence companies add value here with data models that enable them to not only spot trends as they emerge, but to predict which will grow and have influence in the longer term.

Social media is just as much about images, as it is about text. Analysing both images and text together in context can enhance trend spotting. For example, specialist food analysis platform Tastewise uses advanced image recognition tools that study visual cues to help clients gain deeper insight into presentation and plating trends.

Identifying trends: a case study

A great example from Black Swan Data shows how predicting lasting trends can steer innovation. Faced with a challenging category dynamic, shifting consumer behaviour and the sugar tax, PepsiCo wanted to identify opportunities within sparkling water category, to help define their next generation of product innovations. Black Swan Data analysed 157m real-time beverage conversations from online sources, filtered out irrelevant content, applied AI and NLP, identified several thousand trend manifestations, then ranked each trend based on its maturity and future growth potential. Three macro trends emerged:

- Better for you’ sparkling beverages

- Transparency – nothing artificial

- Flavour and function – benefits over and above hydration

The analysis provided the foundations for PepsiCo to develop Bubly, a range of eight flavoured, zero-calorie, sweetener-free sparkling waters, which was launched in the USA in 2018. Within 12 months sales had exceeded $100m.

Understanding audiences

Social data is huge. There are 7.7 billion people in the world, at least 3.5 billion of whom are online. In 2019, social media platforms were used by a third of all people in the world, and more than two-thirds of all internet users. This obviously varies by geography and age, with younger people in wealthier countries approaching 100% usage.

When you are doing social intelligence, it’s as if the world were your sample frame. This enables you to understand, in detail, who is engaging with your brand, your competitors, or your category.

Niche interest groups can be found with ease, and you’re able to profile and segment the people within these groups. You can discover influencers, and micro-influencers (those with smaller followings, but focused on a niche area). Very specific audiences can also be targeted for other research. Combining audience intelligence with other methods, both qualitative and quantitative, can be very powerful.

Understanding audiences: a case study

A project by Pulsar shows the value of social intelligence in reaching and understanding a challenging-to-find group. They looked at high-school students who are thinking of applying to universities in California. The project used data from Twitter, forums, Reddit and Facebook. Firstly, they looked for mentions of California schools and keywords relating to location, and intent, such as ‘LA’ and ‘applying’. Secondly, they created bespoke searches to find the most relevant conversations.

- Twitter shows in-the-moment reactions to acceptance letters, campus tours and other milestones.

- Forums and Reddit contain discussions of student considerations, worries and the processes they go through while looking at college choices.

- Facebook shows parents and family members’ perspectives that affect the students.

They were able to segment the types of students applying and gain several insights about what influences student choices. This helped universities improve their admissions strategy and student prospecting for the next academic year.

Content and communications campaigns

Social intelligence can help you at the front end of a campaign, with designing content and other creative communications.

Social data is a rich source of stories that can inspire your creativity. It can provide insights into the language with which people are talking about your topic, the associated emotions and sentiments. Additionally, it can identify nuances in different markets, and amongst different audience groups.

It’s also a quick source of feedback on campaigns once they’ve been launched. You can see how it’s cutting through, and how well the campaign is being received. Linking this with insight on brand perceptions can help you understand whether you are achieving your communications goals, and what is driving success or otherwise.

What social intelligence is not great for

Primarily, anything where you need to get an accurate measurement or a representative sample.

While a third of the world may be on social media, that third isn’t a representative sample. As a result, you shouldn’t use social intelligence for market sizing, or political polling. That said, social data can add qualitative richness and depth to these types of research conducted in traditional fashions.

You can use social intelligence for customer experience research, but be aware that you’ll mostly pick up the extremes. People often use social media to brag or bitch. You’ll capture those who are super happy with their free upgrade or excellent customer service, alongside those who are super annoyed that something broke, failed or fell apart.

This can be useful in identifying the bottlenecks in your customer experience processes, and surfacing opportunities to improve. However, it can’t tell you how many customers are delighted, or about to churn, unlike a classic NPS survey.

Another area that should perhaps be avoided is trying to understand complex, sensitive, personal or embarrassing topics. Online methods can be really effective for this, as people can open up more than they would in person. However, on social media, people often paint a positive picture of their lives, rather than discuss the details of what is going wrong, whether that is issues around mental health, physical problems or relationship issues.

Search data can be a good way of quantifying some of these issues, but the qualitative detail is probably best left to other methods. Where social intelligence can be helpful is in identifying people with particular conditions or issues for recruitment to other forms of qualitative research.

Expert tips for social intelligence

Sometimes, researchers are put under pressure from the C suite to use new methods just because they are new, shiny and exciting. But, as with any tool, it’s important to understand exactly what you want to achieve.

Jeremy Hollow from Listen and Learn says that a terrible place to start is by just saying “let’s do a bit of social listening…”

Instead, really great social insight projects tend to share the following characteristics:

- They know where the knowledge gaps are.

- There’s an appreciation that other research methods can’t reach this topic or audience, or that they’ve lost the power to find new insight.

- They know what social data is like, the value it brings and its limitations.

- They have a clear idea of where it fits into, and how it will improve the strategic, operational or communication processes.

So, just like any other research method, make sure you have a clear brief and understand the purpose and opportunity before you start.

For more inspiration, we also have a great case study from Pulsar, which looks at how NBC Entertainment built a hybrid method framework connecting survey, social and search data to support faster, cheaper, granular, real-time and hyper-relevant insights for creative development.

Watch the webinar here.

If you’re now looking to choose a platform, check out our Top 10 Platforms for Social Intelligence or our Market Map for Social Intelligence for more information.

Key terminology for social intelligence – mini glossary

- Audience intelligence: The strategic use of existing social media and other public data such as customer reviews, blogs, search data and forums, to gain detailed insights from what people are saying online

- EmotionAI: A catch-all label that covers the use of machine and deep learning techniques to classify users’ emotional states and identify their non-rational responses

- Entity: A predefined category in text analytics, such as person, place or brand

- Social intelligence: A blanket term for all approaches that use social media and other public data to gain insight from what people are saying online

- Social listening: The tactical use of existing social media to monitor and respond to what people are saying online

- Natural language processing: NLP connects linguistics with AI so that computers can analyse written language

- Owned vs earned social media: Owned social media are your companies own social channels, such as your Facebook or Twitter account. Earned social media are the mentions you get spontaneously on public platforms.

- Sentiment analysis: Sentiment analysis tries to work out opinions expressed in text, including polarity – whether the opinion is positive or negative